BISMARCK, N.D. (AP) — North Dakota could become the first state to eventually end property taxes on people’s homes under a proposal from the state’s new governor that combines conservative fiscal policy with the state’s enormous oil wealth.

The plan by Republican Gov. Kelly Armstrong would start with $483 million from the state’s general fund and a portion of earnings from the state’s $11.5 billion oil tax savings with the ultimate goal of wiping out primary residential property taxes in years to come.

“This plan is aggressive, durable and responsible,” Armstrong told the Republican-run Legislature last week.

Property taxes will never win popularity contests, especially for homeowners on a fixed income who can face big bills when tax deadlines approach. But local governments and schools typically rely on property taxes for the essential services they provide to residents.

While officials must be content with griping in most states, North Dakota's voter-approved, oil-derived Legacy Fund generates hundreds of millions of dollars of earnings that would be key to funding Armstrong's plan for property tax relief.

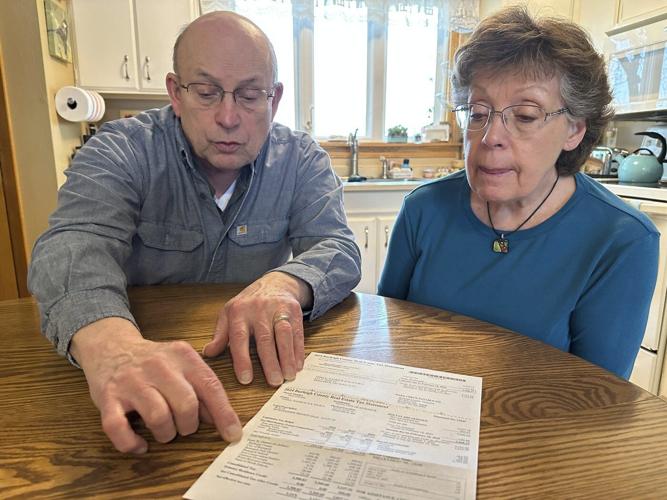

For homeowners like Bismarck retirees Pat and Julie O’Dell, Armstrong’s plan would eventually end their annual property tax bill of over $3,000 for the modest duplex they have lived in for 33 years. That is a big cost for a couple who rely on Social Security and a small pension, Pat O’Dell said.

“In my estimation, I think the state does need to do something because there’s a lot of people in a lot worse shape than I am,” he said.

Armstrong's plan would build on a primary-residence tax credit for a combined, initial relief of up to $1,550 per year, proposed to increase every two years and rely more and more on the oil tax fund's earnings in the future. His plan also includes a 3% cap on future increases in local property tax budgets.

When combined with an expanded property tax credit for income-eligible seniors and people with disabilities, Armstrong said that initial $1,550 would “eliminate property taxes for an entire class of homeowners who need that relief the most, and it would put the bulk of primary residences on a path to zero within the next decade.”

Rising property taxes have frustrated homeowners nationwide. The U.S. is in the midst of a new property tax revolt, said Jared Walczak, vice president of state projects at the Tax Foundation, a nonprofit, nonpartisan tax policy research organization. The issue is largely due to a dramatic increase in assessed values across the country, he said.

The unrest has led to “unrealistic and unproductive” tax proposals in some states, he said. Last fall, North Dakota voters a that would have abolished most local property taxes.

No state has ever gone without property taxes or exempted owner-occupied property from a property tax, Walczak said.

No. 3 U.S. oil producer North Dakota is unusual in that the state raises enough from severance taxes “that it's not out of the question to replace the property tax in the way that it would be in most other states," Walczak said. for instance, it would have essentially required a 22% sales tax, he said.

“Theoretically there's a way to make the math work in a way that's just not true in most states,” Walczak said. “That still doesn't mean that it's efficient use. If the state wants to provide hundreds of millions of dollars worth of tax relief, there are far better ways to do it. But the reason it's even a conversation is the uniqueness of North Dakota's revenue situation.”

North Dakota’s state government has collected billions of dollars in oil and gas tax revenue in its current two-year budget cycle. The state has taken in $481 million or 13% more in those revenues than the Legislature forecasted in 2023, according to a December The Legacy Fund's earnings surpassed $600 million for the state's current two-year budget cycle.

Cuts to income taxes vs. property taxes were a smoldering issue of North Dakota's 2023 session, which resulted in a raft of property tax credits and income tax cuts estimated at $515 million.

A very low or zero income tax would be far more economically productive than zeroing out residential property taxes, Walczak said. North Dakota lawmakers have said their constituents complain much more about property taxes than their income tax.

Those lawmakers are expected to be wading through many property tax bills, a complex issue on top of their usual budget and policy work. North Dakota's legislative session happens every two years and is limited to 80 days, or about four months.

Republican majority leaders and other key lawmakers sponsored a bill that has parts aligned with the governor's plan. Armstrong testified in support of the bill during its hearing Tuesday.

Fargo Mayor Tim Mahoney said he is concerned about sustainability in Armstrong's proposed “path to zero,” but he called it a great goal. Property taxes make up 40% of the budget for North Dakota's largest city, the mayor said.

“To me, the long-term sustainability is extremely critical on any position that anybody has,” said Mahoney, who added he would like to see a plan that helps people on a fixed income.